In June 2020, in response to the Covid-19 crisis, the EU leaders agreed on the establishment of an exceptional and temporary EU recovery plan. Known as “Next Generation EU”, the Plan amounts to €807bn in current prices (the equivalent of 5% of the EU 2020 GDP) and it is financed through the issuance of common EU debt. Most NGEU funds are allocated to a new EU programme, the Recovery and Resilience Facility (RRF), providing financial support to Member States in form of grants and loans to implement national, pre-agreed, multi-annual agendas of investments and reforms. Spain is one of the largest beneficiaries of the RRF, having received €77.4bn in RRF grants to be used between 2020 and 2026.

This article discusses the expected macro-economic impact of the EU Recovery and Resilience Facility (RRF), also known as the “EU Recovery Fund”. After describing the main features of the RRF, it presents the estimations made by the Commission and the ECB on the macro-economic impact of the RRF. Section three then discusses how the new macro-economic scenario generated by Russia’s invasion of Ukraine and the developing energy crisis may alter these estimations. Section four examines in greater detail the expected impact of the RRF funds in Spain. Section five sets out the conclusions.

1. Main features of the Recovery and Resilience Facility

The RRF was created in 2020 with the aim of promoting a coordinated EU fiscal response to the Covid-19 crisis. It is not a classic fiscal stimulus programme, as it combines a short-term objective -boosting the EU’s aggregate demand via an increase in public investment– with a medium to long-term objective –transforming the EU economy through productive-enhancing investments and reforms, notably in the green and digital sector.

In particular, the Facility provides a significant amount of grants (€338 bn) and access to concessional loans (up €386 bn) by the Member States to finance National Recovery and Resilience Plans (NRRP). These Plans must be fully implemented by the end of 2026 and they must support coherent packages of reforms and investments. The notion of investment, however, is understood in broad terms, as the Plans may include fiscal transfers or tax cuts insofar as they are measures with a durable impact. 37% and 20% of the Plans must be allocated to supporting the climate and digital transition respectively. All actions must respect the principle of not causing significant damage to the environment.

At the time of writing this article, 27 Member States have adopted their NRRP. The size of the Plans varies significantly (see Chart 1), reflecting both the uneven distribution of the RRF grants and the willingness of the different Member States to take up the RRF loans.

Chart 1. RRF allocation (grants and loans), in €bn (left axis) and as a % of GDP (right axis)

Source: own elaboration based on Commission and Eurostat data

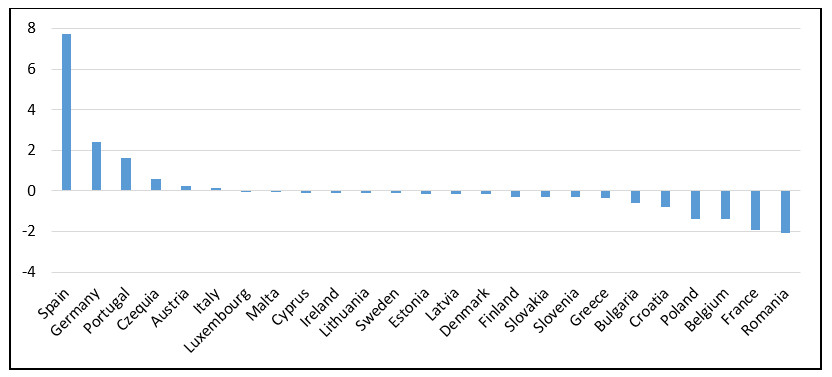

The RRF grants were distributed among the Member States in 2020 following a distribution key based on population, GDP per capita and unemployment levels. To give the Member States some degree of predictability regarding the amount of the RRF grants at their disposal while favouring those most hit by the Covid crisis, it was decided to distribute them in two tranches. The first tranche (70%) was allocated according to pre-Covid data (population and GDP per capita in 2019 and average unemployment rate in 2015-2019). The second tranche (30%) was distributed according to the expected impact of the Covid-19 crisis on the Member State economies (defined as the forecasted GDP loss for 2020 and 2021). In June 2022, the distribution of this 30% tranche was reviewed based on actual GDP data for 2020 and 2021. For some countries, this has led to meaningful changes in the overall RRF grant allocation (see chart 2). Spain, in particular, has seen its RRF grant allocation grow significantly due to an unexpectedly larger fall in GDP after Covid.

Chart 2. Changes in the RRF grant allocation after the June 2021 update (in €bn)

Source: own elaboration based on Commission data

Whereas the €386bn RRF grants have been fully pre-allocated, the take-up of RRF loans is voluntary. The original RRF regulation stipulated that all the Member States could request an amount in loans equivalent to 6.8% of their GNI and that they had to submit their request for loans before August 2023. So far, only seven EU countries have made use of this option, and only three of them (Italy, Greece and Romania) have requested the full amount of the RRF loans they are eligible for. As a result, €196.4bn remains available for RRF loans.

Looking at the governance of the RRF, it is worth noting that the Facility introduces many specificities with respect to more “classic” EU cohesion funds. Firstly, unlike the operational programmes of the cohesion funds, NRRPs include both investment and reform actions. Secondly, RRF funds can be used retrospectively to finance actions taken in response to the pandemic as of February 2020 (in other words, to cover expenses already incurred by national budgets). While this is an option that has also been extended to EU cohesion policy funding in response to recent crises (first the pandemic and then the Ukrainian refugee crisis), retroactive eligibility is the exception rather than the rule for EU funds. Thirdly, the EU cohesion funds are paid out to the Member States at the same rhythm at which they execute the actions (that is, the Commission pays the Member States the costs incurred). In contrast, the RRF funding instalments from the Commission to the Member States are conditional on the progress achieved with respect to the pre-agreed quantitative and qualitative objectives (milestones and targets). Adopting a performance-oriented and not a cost-oriented approach means that the times at which the Commission makes the payments may differ from the times of the actual execution of RRF-financed actions. Lastly, whereas the Commission adopts the Member State cohesion operational plans and makes cohesion fund payments alone, in the case of the RRF, the national plans are adopted by the Council and decisions on disbursements are taken by the Commission, but can be blocked by the Economic and Financial Committee (EFC), a body composed of high-level national officials. Thus, both the quality of the Plans and the progress of the Member States in implementing them will be closely monitored and controlled by the other Member States.

2. Macro-economic impact of the EU Recovery Funds: estimations of the Commission and the ECB

The multiple objectives of the RRF, the complexity of the instrument (combining investments and reforms) and the novelties in the mode of governance makes it particularly difficult to estimate the macro-economic impact of the funds. Moreover, the war in Ukraine and the developing energy crisis have led to major changes in the macro-economic context, challenging the results of estimations conducted before the war.

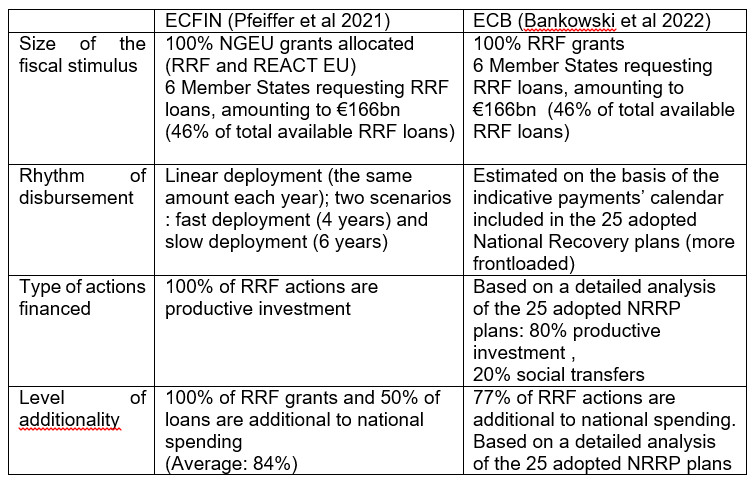

While keeping in mind these caveats, it is helpful to take a look at existing macro-economic estimations. The most robust ones were conducted by the Commission´s DG ECFIN (European Commission 2020, Pfeiffer et al 2021) and by experts from the European Central Bank (Bankowski et al 2021, Bankowski et al 2022). There are various methodological differences between the macro-economic simulation exercises of the ECB and the DG ECFIN (Table 1). Whereas the analyses of the Commission aim to estimate the impact of the “Next Generation EU” package (that is, all the different EU programmes financed by common EU debt raised in response to the pandemic), the ECB studies focus on the impact of the Recovery and Resilience Facility (the most important of all the NGEU programmes). The studies of the Commission assess the impact for the whole Union, whereas the ECB studies focus on the impact for euro area Member States. Lastly, whereas the studies of the Commission estimate the impact in terms of fiscal stimulus, the latest ECB study (Bankowski et al 2022) aims to disentangle the RRF impact through three different channels: the fiscal channel, the risk premium channel and the structural reform channel. We will discuss these three channels separately in the following sections.

Table 1. Differences between the two most recent ECB and DG ECFIN studies estimating the macro-economic impact of the EU Recovery Funds

Sources: Pfeiffer et al 2021, Bankowski et al 2022

2.1. The fiscal channel

Since it is a coordinated fiscal response to the crisis, the main expected effect of the RRF is to raise the GDP via an increase in public expenditure. As explained by the literature on fiscal multipliers, higher public expenditure may increase aggregate demand in the short term and aggregate supply in the medium and long term (IMF 2014). The short-term effect is strongly dependent on the economic cycle. It is much higher in periods of economic downturn than in periods of economic expansion, as the risk of crowding out private demand is lower. The long-term effect, in contrast, depends to a large extent on the composition of public expenditure. In general, fiscal transfers or tax cuts have a much lower multiplier effect in the medium to long term than public investment. Apart from these general teachings from the studies on fiscal multipliers, when assessing the impact of EU-level spending, a key factor to take into account is the additionality of EU funds, that is, the extent to which they are used to finance new measures or to replace national budgets.

All these general considerations point to different variables that can determine the greater or lesser fiscal impact of the RRF funds, such as the size of the funds, the rhythm of disbursement, the type of RRF actions financed and the level of additionality with respect to national budgets. The first studies estimating the impact of the EU Recovery Funds were hampered by a lack of information (see e.g. European Commission 2020, Codogno et al 2021, Watzka and Watt 2020). Since they were conducted before the Plans were adopted, they had to rely on numerous assumptions as regards the size, duration and composition of the Plans, which later proved to be false. For instance, the first studies assumed the full uptake of RRF loans and expected a bigger slice of the RRF to be spent in the form of grants rather than loans.

More recent studies have been based on more realistic assumptions (Table 2). In particular, the latest ECB analysis (Bankowski et al 2022) is grounded on accurate assumptions on the disbursement rhythm of the RRF funds as well as the nature of the RRF actions financed, as it relies on a granular analysis of the content of the 25 adopted NRRPs.

Table 2. Assumptions used as a basis for the ECB and the DG ECFIN calculation of the fiscal stimulus stemming from RRF funds

Sources: Pfeiffer et al 2021, Bankowski et al 2022

On observing the results of the studies of the Commission and the ECB (see Table 1), we see that the estimated fiscal impact of the Commission is stronger, both in the short term (+1.2% of EU GDP by 2024 compared to +0.6% by 2023 estimated by ECB analysis) and in the medium term (+0.8% vs +0.4% by 2026). This can be explained by the fact that the Commission assesses the impact of all NGEU funds (roughly €800bn) and not only RRF funds (€726bn). It also focuses on the impact for the whole Union and not only for a sub-set of countries (the euro area countries). Given that the euro area includes many Member States that receive low amounts of RRF funds per capita, the focus on the euro area may also lead to an expected lower fiscal impact. Lastly, the study of the Commission (Pfeiffer et al 2022) quantifies both the direct effect of RRF funds on each country´s domestic demand and the indirect effect on other countries’ economies through trade spillovers. The study concludes that spillover effects account for almost one third of the total RRF impact. For small and open economies such as Luxembourg, Denmark or Ireland, this indirect effect is even larger than the direct effect of spending their own RRF envelope.

Both studies also provide estimates of the fiscal impact for each Member State. Not surprisingly, the impact is stronger for large countries receiving higher amounts of RRF funds (particularly Italy and Spain). However, the speed and intensity of the impact also depends on the expected rhythm of disbursement, which varies from country to country, as each Member State has negotiated its own calendar of milestones, targets and corresponding EU payments with the Commission. Chart 3 shows the timelines of the different Plans. As can be observed, some countries (Greece, Italy and Romania) are expected to receive the RRF payments at relatively regular intervals during the entire 2021-26 period, whereas others (France, Spain and Portugal) have preferred to frontload the RRF payments during the first years.

Chart 3. Timelines of the different National RFF Plans

Source: own elaboration based on data from the different NRRPs

The content of the RRF Plans is also different from country to country, leading to different fiscal stimulus effects. According to the ECB study, some countries (e.g. Greece or Spain) will use most of the RRF funds to finance additional measures whereas others (e.g. Germany, Luxembourg and, to a lesser extent, Austria) will use an important part of the RRF funds to cover the costs of measures already financed by national budgets. There are also differences in the nature of the RRF actions financed. Some countries (Spain, Greece and Italy) have allocated more than 80% of the funds to public or private investments, while others allocate roughly 40-50% of the RRF funds to financing social transfers or other current expenditures (Germany and France).

2.2. The structural reform channel

The RRF is also expected to have a transformative impact by incentivising the adoption and implementation of reforms. Assessing the impact of the RRF reforms, however, is particularly difficult. Existing macro-economic models are well geared to quantify the impact of “classic” labour, service and good liberalisation reforms. There is a large amount of literature on the effects of such reforms, and the models are quite robust in associating different types of reform measures with different changes expected in price markups in labour, service and goods markets. Nonetheless, most of the reforms included in the NRRP are not these classic liberalisation reforms which were so noticeable in the 2011-2013 euro area bailout programmes. The RRF´s reform agendas are dominated by public sector reforms (e.g. reforms aimed at improving public procurement procedures, reform of the judiciary system), changes in framework conditions to facilitate the green and digital transition (e.g. establishment of new efficiency standards for buildings) and “soft” labour market policies (measures related to digital skills and active labour market policies). These types of reforms are expected to have no adverse macro-economic effects in the short term (contrary to what happens with some liberalisation reforms) and positive effects in the long term via a reduction of public sector inefficiencies, improvements in the quality of public investment and favouring private investment on green and digital. However, it is difficult to estimate their effect on long-term growth, as the impact is less straightforward than for classic liberalisation reforms.

The only study that has attempted to estimate the effect of the RRF reform component is Bankowski et al (2022). The study concludes that, on average, the reforms envisaged in the NRRPs could result in a 1% increase in the euro area GDP by 2030. Even so, it also considers that the overall impact may be underestimated due to the difficulties in capturing the impact of this type of reforms on growth by standard macroeconomic models. Bankowski et al also provide estimates per country. The largest impact is estimated to be in Italy (+3.1% of the GDP by 2030), which has one of the most ambitious plans in terms of reforms. On the contrary, , the reform component is very modest in the German plan, and thus the impact of reforms is expected to be quite limited (only +0.1%).

2.3. The risk premium channel

The risk premium channel refers to the effect that the creation of NGEU had on the financial sovereign debt market. In fact the announcement of the EU Recovery Plan in July 2020 generated confidence and gave rise to a reduction in the sovereign risk premia for the most vulnerable economies in the euro area. Bankowski et al (2022) have tried to quantify this effect. The main difficulty when doing so is to disentangle the NGEU effect from the effect generated by the creation of a new ECB programme to buy public debt (the Pandemic Emergency Purchase Programme – PEPP) which was also announced in the spring of 2020. Looking in detail at the evolution of spreads across time, Bankowski et al observe however that there was a temporary downward of sovereign yields right after the announcement of the ECB PEPP programme (March 2020) but it was the Franco-German initiative of 18 May 2020, the forerunner of NGEU, that helped produce a clear downward impact on sovereign risk premia. This reduction resulted in savings for sovereigns and stimulating effects for the entire euro area economy. The study estimates that this downturn will lead to a 0.2% increase in the euro area GDP by 2026, with significantly greater effects for highly indebted countries such as Italy and Spain.

3. Possible implications of the war in Ukraine for the implementation and impact of RRF funds

Both the ECB and Commission´s macro-economic estimations of the effects of the Recovery Funds were conducted before Russia’s invasion of Ukraine. They assumed that the funds would support a post-Covid expansionary phase and would be disbursed in a context of low inflation and low interest rates. The situation, however, has changed significantly in recent months. The inflation rate is at levels unforeseen for decades, the ECB has risen its interest rate and it is expected to normalise the highly accommodative policy of the last years and the EU economy is at risk of falling into recession next year.

This change in the macro-economic context will undoubtedly alter the impact of the Recovery Plans on the economy but its effect is uncertain. On the one hand, if the EU economy enters into recession, the fiscal multiplier may be stronger than estimated. Besides, in case of tensions in the sovereign debt market, more EU countries will be interested in taking up RRF loans, thus increasing the RRF’s overall fiscal effect. A financial market subject to tensions will also generate an additional risk premium effect beyond the “announced” downward effect created in May 2020. On the other hand, the literature indicates that persistent low interest rates are conducive to higher fiscal multipliers, as they reduce the risk of crowding out (Di Serio et al 2021). Besides, rising production costs, supply bottlenecks and skill shortages may hamper the implementation of the Plan. Last but not least, the Member States may find it difficult to finance all the RRF projects included in their Plans. The size of the NRRP was fixed in advance on the basis of an estimation of the costs of all the investments covered by the Plans, but the costs were estimated using a projected 2% annual inflation rate. With inflation at 9 or 10%, RRF payments may therefore prove insufficient to cover the costs of all the RRF actions.

Whereas it is difficult to predict how the new macro-economic context will affect the impact of the Plans on the economy, what seems clear is that the war will bring about changes in the content of the Plans. This is the goal of the May 2022 “REPOWER EU” proposal, currently under negotiation between the Council and the Parliament. The proposal aims to include a new chapter in all National Recovery Plans focused on energy-related investments and reforms. These chapters will contain “green deal” investments -such as investments in renewables or energy efficiency– and investments in fossil fuel infrastructure, such as new LNG terminals and gas storage capacity. To finance these new chapters, the Commission invites the Member States to make use of the remaining €220bn of the RRF loans. It also allows them to transfer an additional 7.5% of their EU cohesion policy envelope (roughly €30bn) to the RRF. The Commission also proposes raising an additional €20bn by auctioning the EU Emission Trading System (ETS) allowances to finance these REPOWER chapters.

Finally, apart from the difficulties posed by the war, we should not forget that there are other specific risks and challenges inherent to the implementation of the NRRPs. On the one hand, the RRF funds must be spent in full within six years (2021-2026), a shorter period than the usual 7-year period granted to the Member States to use their cohesion funds. This requires an important institutional capacity to ensure the successful selection and timely execution of investment projects, particularly for those countries with large and ambitious plans and which also receive important amounts of cohesion funding – as is the case of Spain. On the other hand, reform conditionality is always a challenging exercise. In the case of the RRF, there may not be major problems of ownership, as the reforms included in the Plans have been proposed by the beneficiary Member States. However, the adoption and implementation of reforms will be monitored through qualitative milestones measuring outputs (e.g. adoption of a law) rather than quantitative impact-oriented targets (e.g. reduction in the average length of public procurement procedures). There is thus a risk that the adopted reforms will be improperly implemented on the ground and not achieve their intended impact.

4. Macro-economic impact of the RRF funds in Spain

The Spanish Recovery Plan is the second largest after the Italian one. It amounts to €69.5bn in grants, the equivalent of 5.6% of the Spanish GDP in 2019. Compared to other NRRPs, the Spanish Plan stands out for the profile of the payment calendars, with payments being strongly frontloaded during the first years. It also contains a large number of reforms, even if not all of them are major structural reforms.

At the moment of presenting the Plan, the Spanish government did not provide detailed information on its expected macro-economic impact. It was only indicated that the Plan would increase the GDP by 2.7 pp in 2021 and by 2 pp on average during the 2021-2023 period, and that it could lead to an increase of 0.4 pp in the long-term GDP1. These estimates were overly optimistic, as pointed out by the Commission in the Plan´s assessment. They were based on a fiscal multiplier of 1.2. and on an assumption of full and timely implementation of all RRF projects according to a government’s ambitious timeline – which foresaw the execution of roughly €25bn of the RRF funds in 2021, €25bn in 2022 and €19bn in 2023.

The Spanish Independent Authority for Fiscal Responsibility (AIREF) accepted the assumption on the fiscal multiplier –while pointing out the large amount of uncertainty about it- but was sceptical regarding the capacity to execute all the RRF funds according to the government´s plans. In its report on the 2021-2024 Spanish stability programme, it estimated that the Plan’s biggest impact would be in 2022 rather than 20212. The Commission was even more cautious about the rhythm of disbursement and thus estimated that the biggest impact would take place in 2023 (table 4).

Table 3. Comparing the macro-economic estimations of the impact of the Spanish NRRP on GDP (pp deviation of real GDP level versus non-RRF scenario)

Sources: Spanish Stability Programme 2021-2024, AIREF (2021), AIREF (2022), European Commission (2021), Banco de España (2021) and Spanish Ministry of Finance (2022)

More recently, significant delays in the allocation of the RRF funds during 2021 as well as reported difficulties in the execution of some projects have led to a review of these estimations. In its report on the 2022-2024 Spanish Stability programme3, the AIREF reduces the fiscal multiplier to 0.9 and estimates that the Plan will lead to an increase of 1.8 pp of the GDP by 2022, 1.8 pp in 2023 and 2.3 pp in 2023. The fiscal authority justifies the adoption of a lower multiplier due to the fact that the RRF funds will be spent in a more adverse economic context, characterised by higher interest rates, a rise in production costs, supply disruptions and a tight labour market in strategic sectors for the deployment of the NRRPs such as the automotive industry, the construction industry or the digital sector. The Bank of Spain also points at a more moderate impact. In its December 2021 Economic forecast4, it estimates that the RRF funds will increase the GDP by only 0.3 pp in 2021 and by 1.6 pp in 2022. Lastly, the Spanish Government has also reviewed its macro-economic estimations5. The Government’s new estimates are closer to those of AIREF, with an expected impact of 0.7 pp in 2021, 1.9 pp in 2022 and 1.8 pp in 2023. In these last estimates, the Spanish Government has included the impact of the reforms. According to the Government’s calculations, from 2024 onwards the impact of the Plan will be mostly due to the positive effect of the reforms. These could increase the Spanish GDP by 3 pp in the long term (2030). Half of this increase would come from labour market reforms and reforms in the area of skills and education.

The great uncertainty about all these estimates should be noted. Leaving aside possible delays in the execution of the projects, it is very difficult to determine a fiscal multiplier for all the Spanish RRF funds. The literature gives some indication about the fiscal multipliers of “classic” investments in physical and human capital, but there is little evidence of the macroeconomic effects of innovative investments in areas such as the Artificial Intelligence Strategy or Research and Innovation in Hydrogen. Besides, the Spanish Plan foresees that a substantial part of the RRF funds should be implemented through the so-called Strategic Projects or PERTES. The impact of these projects is strongly dependent on the capacity to mobilise key private firms in these specific strategic areas. The Plan is also very vague as to the content of some key reforms, such as the fiscal reforms. There is also a lack of transparency on the implementation, monitoring and evaluation of the RRF projects –something that has been criticised by the AIREF.

Finally, the Government is currently working on an amendment of the Plan which responds both to the REPOWER proposal and the need to plan for the additional €7.7bn in grants received from the July 2022 update (see section 2). It has already indicated its intention to request €84bn of the RRF loans. This increase in the size and ambition of the Plan should logically increase the Plan’s macro-economic impact.

Conclusions

The Recovery and Resilience Facility (RRF) is an unprecedented EU tool that provides significant support to the Member States in implementing national pre-agreed multi-annual agendas of investments and reforms. It is expected to have an important macro-economic effect on the EU economies through three different channels: increasing public expenditure -particularly investment in climate action and digital transformation-, incentivising the adoption and implementation of reforms and reducing sovereign debt premia for the most indebted countries.

However, it is not easy to estimate its effects. The RRF presents many novelties in terms of governance, making it difficult to compare it with other existing EU funds. Besides, the range of investment projects financed is very large and there are major uncertainties as regards the capacity of the Member States to fully implement all the investment projects in a timely and effective way and to adopt and implement all the reforms. Last but not least, changes in the macro-economic context may alter the impact of the Recovery Plans on the economy, but their effect is not known.

Despite all these limitations, a look at the existing macro-economic estimations confirms the potential of these funds to help sustain the EU economy at a time of great uncertainty and the risk of recession. Whether this impact disappears or, on the contrary, remains persistent over time will largely depend on how effective implementation of the investments and reforms is in those countries receiving the largest amounts of RRF funds, particularly Italy and Spain.

About the author:

Eulalia Rubio Barceló is senior Research Fellow on European economic affairs at the Jacques Delors Institute in Paris. Her field of expertise is the EU´s budgetary and public investment policies.

References

- Alonso, D, Kataryniuk, I, Moreno, C and Pérez, Javier J, (2022) “El programa Next Generatio EU: características y claves para su éxito”, ICE: Revista de economía, No 924, January-February

- Autoridad Independiente de Responsabilidad Fiscal (AIREF), (2021) “Informe sobre la actualización del programa de estabilidad 2021-2024”, Informe 20/21, 11 May 2021

- Autoridad Independiente de Responsabilidad Fiscal (AIREF),(2022) “Informe sobre la actualización del programa de estabilidad 2022-2025”, Informe 21/22, 12 May 2022

- Banco de España (2021), “Proyecciones macroeconómicas de la economía española (2021-2024): contribución del Banco de España al ejercicio conjunto de proyecciones del Eurosistema de diciembre de 2021”, December 2021

- Bańkowski, K., Ferdinandusse, M., Hauptmeier, S., Jacquinot, P. and Valenta, V.(2021), “The macroeconomic impact of the Next Generation EU Instrument on the euro area”, Occasional Paper Series, No 255, ECB, January

- Bańkowski, K. Bouabdallah, O., Domingues Semeano, J., Dorrucci, E., Freier, M., Jacquinot, P. Modery, W. Rodríguez-Vives, M. Valenta, V. and Zorell, N (2022), “The economic impact of NextGeneration EU: a euro area perspective”, Occasional Paper Series, No 291, ECB, April

- Codogno L. and van den Noord, P. (2021), “Assessing Next Generation EU”, LSE ‘Europe in Question’ Discussion Paper Series, No166, European Institute, LES

- Di Serio, M, Fragetta, M. and Melina, G.(2021) “The Impact of r-g on the Euro-Area Government Spending Multiplier”., IMF working paper, WP 21/39, 2021.

- European Commission (2020),“Identifying Europe’s recovery needs”, European Commission Staff Working Document SWD(2020)

- European Commission (2021), “Analysis of the recovery and resilience plan of Spain. Accompanying the Proposal for a Council Implementing Decision on the approval of the assessment of the recovery and resilience plan for Spain”, Staff Working Document 147, 16.6.2021

- Freier, M., Grynberg, C., O’Connell, M., Rodríguez-Vives, M. and Zorell, N. (2022), “Next Generation EU: A euro area perspective”, Economic Bulletin, No 1, ECB.

- Pfeiffer, P., Varga, J. and in ’t Veld, J. (2021), “Quantifying Spillovers of Next Generation EU Investment”, European Economy Discussion Papers, No 144, European Commission, July.

- Picek, Olivier (2020) “Spillover Effects From Next Generation EU”, Intereconomics volume 55, p 325–331

- Spanish ministry of economy and digital transformation (2021), “Stability programme update 2021-2024. Kingdom of Spain”, 2021

- Spanish ministry of economy and digital transformation (2022), “Stability programme update 2022-2025 Kingdom of Spain”

- Spanish ministry of economy and digital transformation (2022), “Presentación de los avances en la ejecución del Plan de Recuperación, Transformación y Resiliencia”, comparecencia de la ministra Calviño delante de la Comisión mixta del Congreso, 22 septiembre 2022, chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.lamoncloa.gob.es/serviciosdeprensa/notasprensa/asuntos-economicos/Documents/2022/220922-PRTR-balance-ejecucion.pdf

- Watzka, S. and Watt, A. (2020), “The macroeconomic effects of the EU Recovery and Resilience Facility”, IMK Policy Brief, No 98, October.

- Verwey, M., S. Langedijk and R. Kuenzel (2020), “Next Generation EU: A recovery plan for Europe”, VoxEU, https://voxeu.org/article/nextgeneration-eu-recovery-plan-europe (10 September 2020).

Allusions

- This contrasts with the more detailed information provided by other governments. The German government, for instance, provided estimates on each of the Plan´s component impact on GDP over 2, 5 and 20 years and the Italian and French governments also gave estimates broken down by different components or type of expenditures and on annual basis (see AIREF, 2021, p. 35-37)

- See AIREF (2021)

- AIREF (2021)

- Banco de España (2021)

- https://www.lamoncloa.gob.es/lang/en/gobierno/news/Paginas/2022/20220922_rtrp_progress.aspx#:~:text=The%20Vice%2DPresident%20of%20the,average%20each%20year%20until%202031.