In response to the global financial crisis, international regulators introduced a package of new banking regulations that added to central banks’ toolkits. Their adequate implementation requires frameworks to enable the monitoring of systemic risks. This note focuses on the definition and measurement of cyclical systemic risks, as well as on how their dynamics relate to the operationalization of the countercyclical capital buffer. To do so, it reviews macroprudential actions taken by European national authorities before and since the outbreak of the coronavirus pandemic.

Disclaimer

The views presented in this paper are those of the author alone and do not necessarily represent the official views of the Central Bank of Ireland or the European System of Central Banks.

Introduction

In response to the global financial crisis (GFC), international regulators introduced a package of new banking regulations, known as Basel III. The new tools that were added to central banks’ toolkits included borrower-based and capital measures. The latter impact bank leverage by requiring a larger portion of liabilities to be held in the form of equity. To ensure that the financial system supports the economy, these instruments need to be deployed in an adequate and timely manner. Therefore, macroprudential authorities monitor the emergence of cyclical and structural risks that are sufficiently large to materially impact macro-financial conditions.

Prior to the GFC, banking regulations focused heavily on the risk-weighted capital ratio to determine a bank’s capacity to absorb losses. This metric of bank health is computed as the ratio of a bank’s capital relative to its assets weighted by their level of riskiness1. Nonetheless, the GFC revealed that a number of financial institutions whose capital base appeared to meet the regulatory standards entered the financial crisis with capital of insufficient quantity and quality to absorb market shocks. In response, Basel III enriched the regulatory framework by developing new liquidity, leverage and capital standards aimed at increasing banks’ capacity to absorb losses and thereby make the banking sector more resilient (European Commission (2011)). For instance, the countercyclical capital buffer (CCyB) represents a new element of Basel III.

The CCyB is a capital requirement of all banks during the expansive phases of the credit cycle. Its purpose is to reduce excessive credit growth, either on aggregate or focusing on a specific segment of the lending market. It is aimed at increasing banks’ solvency in order for potential credit losses to be absorbed during a cyclical downturn. Acting counter-cyclically by expanding banks’ capital floors in “good-times” should minimize the negative impact of a contraction of banks’ lending flow to the real economy during “bad-times”. In other words, the goal of macroprudential policy instruments like the CCyB is to strengthen the financial system so that lending to households and businesses is not disrupted when economic shocks occur.

According to the Basel III guidelines, the activation of the CCyB is left at the discretion of national authorities. The rate will normally be between 0 and 2.5% of each bank’s risk weighted assets and is established on top of the regulatory minimum capital requirement (Figure 1). In special circumstances, the buffer can also be set above 2.5%. Automatic reciprocity for the countercyclical capital buffer only applies for rates up to and including 2.5%. If the buffer rate is above 2.5%, reciprocity is optional (for more details of the procedures for national authorities operating the countercyclical buffer regime, see BIS (2010)).

| Figure 1. Capital Requirements2 |

|

In the aftermath of the GFC, macroprudential authorities (including central banks and banking supervisors) have increasingly enforced macroprudential instruments like the CCyB to make the banking system more resilient. However, the potential challenges to the economy triggered by the Covid-19 pandemic have led to a macroprudential policy response across jurisdictions in order to support the ability of financial institutions to supply credit to households and businesses.

This note aims to review the definition and measurement of cyclical systemic risks, as well as their relation with the operationalization of the CCyB. To do so, we will analyse macroprudential actions taken by national authorities before and since the outbreak of the coronavirus pandemic.

Mapping macro – financial imbalances: the credit cycle

Cyclical risks are the propensities of financial conditions to ease and debt to accumulate over a period of economic strengthening and increased complacency. The cycle usually begins with a positive development, for instance the discovery of a widely used new technology or a new market. A period of prosperity and macroeconomic stability follows, typically leading to optimistic expectations with regard to future prospects. In this context, mutually-reinforcing interactions between debt (e.g. credit) and asset prices (e.g. house prices) are triggered3.

The vulnerabilities that build up over the boom period are only uncovered by a downturn in economic conditions, which makes it hard to measure their concentration in real time. The materialization of risk is followed by a revision of future expectations by the lenders, which leads to curtailing of the flow of lending4. In parallel, borrowers react with reduced spending and in extreme cases even default (see Carney (2020)). Several studies show that these responses lead to greater and longer economic downturns5.

The fact that “the turning points and intensity of the financial cycle are not directly observable” (Jorda (2011)) poses a challenge to the operationalization of the CCyB. Since the implementation of the CCyB is related to the sustainability of the interactions between the financial sector and the real economy, an assessment of the ongoing level of cyclical systemic risk is required. Besides the difficulties related to its identification, due to the vast and complex interconnections between the real economy and the financial sector, several quantitative methods have been put forward to map the evolution of cyclical risks into a single indicator. Analogous to the business cycle, such indicators are being referred to as measures of the financial cycle or credit cycle. The most prominent include the Basel-gap.

The Basel-gap is determined by the deviations from equilibrium financial developments, which are approximated using a statistical filter to estimate the long-term trend in the credit-to-GDP ratio6. The Basel-gap shares a common interpretation with other measures of the credit cycle: upward trajectories can be read as a build-up in cyclical risk level, while downward tendencies suggest periods of risk materialization or dissipation.

However, recent research has put the spotlight on the limitations of this indicator. According to Schüler et al. (2020), the Basel-gap does not always accurately reflect countries’ financial cycle positions since the method stipulated for its estimation has two shortcomings. The first is the risk of obtaining spurious cycles due to the predetermined assumption of the duration of the cycle. Secondly, end-point biases might impair the real-time properties of the filter7. Failures to identify the evolution of the risk environment in real-time limits the scope of action of macroprudential authorities to identify and target emerging cyclical vulnerabilities. Besides, Lang and Welz (2017) emphasize that overly persistent trends are an undesirable statistical property of the Basel-gap since, under certain conditions, cyclical turns might be dampened. Therefore, to circumvent these shortcomings, a number of alternative methods have been developed to measure cyclical systemic patterns in the financial system8.

Despite the aforesaid methodological limitations, various studies show that the build-up phases of the Basel-gap have significant forecasting properties signalling systemic banking crises (e.g. Borio and Lowe (2002), Borio and Drehmann (2009), Aldasoro, et al. (2018) and Detken et al. (2014)). Because of its early warning properties and simplicity in terms of computation, following European Union (EU) legislation the Basel-gap should serve as the main reference indicator to measure the credit cycle as well as to calibrate the CCyB rate setting9. Concretely, the Bank’s recommendation of International Settlements (BIS) suggests a CCyB rate of 0% for a Basel-gap below the 2% threshold and a rate of 2.5% when the Basel-gap is above 10% (BCBS, 2010). The following section reviews the instances in which the CCyB has been implemented in Europe and assesses whether the recommended buffer guide applies.

Targeting cyclical risks: CCyB implementation across Europe

Before the Covid – 19 shock

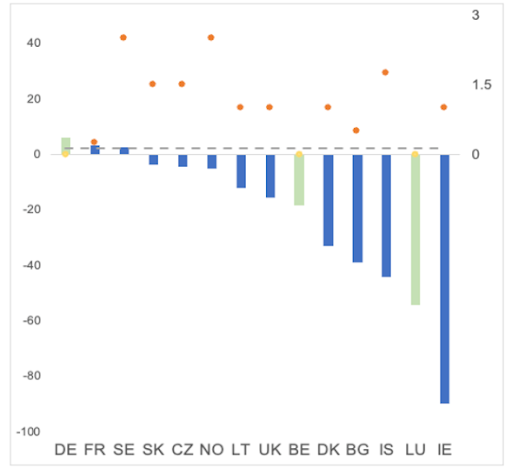

As of 2019, 11 European jurisdictions had set a non-zero CCyB rate. Additionally, Belgium, Germany and Luxembourg had announced the implementation of a positive rate in 2020. Figure 2 shows the countries in which policy action was taken to target the built-up of cyclical risk through the CCyB. The dots show the CCyB rates that were applicable towards the end of 2019 and the bars represent the Basel-gap of each listed country.

| Figure 2. Effective CCyB rates and Basel-gap |

Note: LHS -The bars represent the Basel-gap of each listed country: The blue coloured bars mark the countries that had a positive rate in 2019, while for those countries in which the positive rate would be set in 2020 the bars are green. RHS- The dots mark the CCyB rates that were applicable as of year-end 2019. Orange dots display the positive CCyB rates, while yellow dots show those rates that at that point in time were zero but pending the implementation of a positive rate in 2020. The dashed line represents the 2pp threshold recommended by the BCBS as the activation point of the CCyB. |

| Sources: ESRB and Bank of England |

On average, the Basel-gap of those European countries that set a non-zero rate in pre-Covid 19 times was in the negative terrain, which according to the standard interpretation suggests a period of low cyclical-risk (Galán (2019)). Some of the widest gaps in Figure 2 are those of countries that, after a period of rapid credit growth during pre-GFC times, underwent sharp credit contractions. As outlined in the previous section, this result is an artefact of the filter used to compute the Basel-gap: during the boom period the estimate of trend partly incorporates the credit excesses and, since it is highly persistent, in the post-crisis recovery period it shadows emerging expansionary dynamics.

Most countries included in this study had a Basel-gap below the 2pp threshold recommended by the BCBS as the activation point of the CCyB (dashed line in Figure 2). A degree of judgment in assessing the increase in cyclical systemic vulnerabilities was applied instead of merely following a mechanical link between the Basel-gap and policy decisions (ESRB (2018)). The frameworks that support the CCyB setting consist of a wide range of indicators related to developments in credit, market risks and banking, among others (BIS (2017)).

Post the Covid – 19 shock

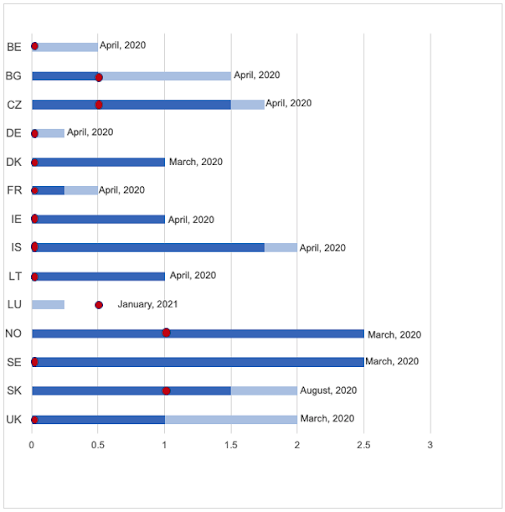

In reaction to the Covid-19 shock, 7 European macroprudential authorities reduced the CCyB rate to 0%. Additionally, Belgium and Germany revoked the previously announced CCyB activations that should have become effective in 2020.

Bulgaria withdrew its previously announced CCyB increase and Norway and the Czech Republic decreased their rates to 0.5%. Figure 3 provides an overview of these policy actions.

| Figure 3. Pre & Post Covid – 19 shock effective CCyB rates |

Note: The dark bars represent the CCyB rates at year-end 2019, the light bars show the rate increases that were announced for 2020 and the red dots show the effective CCyB rates at year-end 2020. RHS Implementation dates. |

| Sources: ESRB and Bank of England |

The release of the buffer is intended to free up capital that would otherwise have been used to meet capital requirements. This should allow banks to provide sufficient lending credit to businesses and households, thereby partially offsetting the devastating impact of the pandemic on the economy (see Bank of Lithuania (2020) and De Nora et al. (2020)). Bank of England researchers predicted that released required capital could amount to $64bn worldwide by the second quarter of 2020 (see Reinhardt and van Hombeeck (2020))10. According to their calculations, this should enable banks to absorb higher risk weights and thereby support up to $530bn in new loans globally.

Concluding Remarks

The GFC revealed a number of vulnerabilities in the European banking system. As a post-crisis response, new instruments were added to macroprudential authorities’ toolkits, such as the CCyB, which is a time-varying instrument to ensure that banking sector capital requirements take stock of the macro-financial environment in which banks operate, thereby making the banking system more resilient. This note has briefly discussed the challenges for the measurement of cyclical vulnerabilities, which is fundamental for the operationalization of the CCyB. It also reviews CCyB implementation by European macroprudential authorities prior to 2019, as well as the policy response to the Covid-19 shock.

The Covid-19 shock highlighted vulnerabilities related to non-bank financial intermediation. In the post global financial crisis period, non-bank financial intermediaries have become increasingly important in the composition of the euro area financial structure (European Central Bank (2020)). Therefore, disruptions to the supply of market-based finance are more likely to be transmitted to the broader economy and financial system than in the early 2000s11.

A number of proposals have been put forward by financial stability authorities (e.g. FSB (2017), ESRB (2017) and IOSCO (2019)) to address vulnerabilities in non-bank financial intermediation but these have yet to culminate in an operational macroprudential policy framework. The Covid-19 shock highlighted vulnerabilities related to market-based financing and therefore the development of a macroprudential framework for non-banks is a key focus area for financial regulators (Quarles (2021)). Nonetheless, the “size, complexity, diversity and the very large number of entities making up the global market-based finance sector”, (Makhlouf (2020)) requires several considerations for the development of a macroprudential toolkit for non-banks12.

References

- A’Hearn, Brian and Ulrich Woitek (2001). “More international evidence on the historical properties of business cycles.” Journal of Monetary Economics, 47(2):321–346.

- Aldasoro, Inaki, Claudio Borio and Mathias Drehmann (2018). “Early warning indicators of banking crises: expanding the family,” BIS Quarterly Review, Bank for International Settlements.

- Bank of International Settlements (BIS)

- (2010). “Guidance for national authorities operating the countercyclical capital buffer”, Basel Committee on Banking Supervision

- (2017). “Range of practices in implementing the countercyclical capital buffer policy”, Basel Committee on Banking Supervision

- Bank of Lithuania (2020) “Bank of Lithuania releases the countercyclical capital buffer requirement amid COVID-19 disruptions”, https://www.lb.lt/en/news/bank-of-lithuania-releases-the-countercyclical-capital-buffer-requirement-amid-covid-19-disruptions

- Borio, Claudio and Mathias Drehmann (2009).”Assessing the risk of banking crises-revisited,” BIS Quarterly Review, Bank for International Settlements.

- Borio, Claudio and Philip Lowe (2002). “Assessing the risk of banking crises.” BIS Quarterly Review, Bank for International Settlements, 43-54

- Carney, Mark (2020). “The Grand Unifying Theory (and practice) of Macroprudential Policy”, Speech at Logan Hall, University College 5 March.

- Claessens, Stijn, M.Ayhan Kose and Marco E.Terrones (2012) “How do business and financial cycles interact?” Journal of International Economics, Vol. 87, Issue 1.

- Cogley, Timothy and James M. Nason (1995). “Effects of the Hodrick-Prescott filter on trend and difference stationary time series implications for business cycle research.” Journal of Economic Dynamics and Control, 19(1-2):253–278.

- de Guindos, Luis (2019). “Key vulnerabilities for euro area financial stability”. Remarks at the meeting of the Financial Stability Contact Group 2 October. https://www.ecb.europa.eu/press/key/date/2019/html/ecb.sp191002~e8a0faff45.en.html

- de Guindos, Luis (2020). “Financial stability and the pandemic crisis”. Remarks at the Frankfurt Finance Summit 22 June. https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp200622~422531a969.en.html

- De Nora, Giorgia, Eoin O’Brien and Martin O’Brien (2020). “Releasing the CCyB to support the economy in a time of stress.” Financial Stability Notes 1/FS/20, Central Bank of Ireland.

- Detken, Carsten, Olaf Weeken, Lucia Alessi, Diana Bonfim, Miguel Boucinha, Christian Castro, Sebastian Frontczak, Gaston Giordana, Julia Giese, Nadya Wildmann, Jan Kakes and B. Klaus (2014). “Operationalising the countercyclical capital buffer:

indicator selection, threshold identification and calibration options,” ESRB Occasional Paper Series 5, European Systemic Risk Board. - European Systemic Risk Board (ESRB) (2017). “Recommendation of the European Systemic Risk Board of 7 December 2017 on liquidity and leverage risks in investment funds (ESRB/2017/6)”

- European Central Bank (2020) Financial Integration and Structure in the Euro Area. https://www.ecb.europa.eu/pub/fie/html/ecb.fie202003~197074785e.en.html#toc1

- European Commission (2011) “CRD IV-Frequently Asked Questions”, https://ec.europa.eu/commission/presscorner/detail/de/MEMO_11_527

- Financial Stability Board (FSB) (2017). “Policy Recommendations to Address Structural Vulnerabilities from Asset Management Activities”

- Galán, Jorge (2019). “Measuring credit-to-gdp gaps. The Hodrick-Prescott filter revisited.” Banco de España Occasional Paper 1906.

- Galán, Jorge and Javier Mencia (2018). “Empirical assessment of alternative structural methods for identifying cyclical systemic risk in Europe.” Banco de España Working Paper.

- Harvey, Andrew and Albert Jaeger (1993). “Detrending, stylized facts and the business cycle.” Journal of Applied Econometrics, 8(3):231–247.

- Hodrick, Robert J. and Edward C. Prescott, (1997). “Postwar us business cycles: an empirical investigation.” Journal of Money, Credit and Banking, pages 1–16.

- International Organization of Securities Commissions (IOSCO) (2019). “Recommendations for a Framework Assessing Leverage in Investment Funds”.

- Jorda, Oscar (2011). “Anchoring countercyclical capital buffers: the role of credit aggregates: discussion.” International Journal of Central Banking, 7, 241-259.

- Jorda, Oscar, Moritz Schularick and Alan M. Taylor (2011).”Financial crises, credit booms, and external imbalances: 140 years of lessons.” IMF Economic Review, 59, 340-378.

- Lang, Jan H, and Peter Welz (2017). “Measuring Credit Gaps for Macroprudential Policy,” Financial Stability Review, European Central Bank, vol. 1.

- Lang, Jan H. and Peter Welz (2018). “Semi-structural credit gap estimation.” ECB Working Paper.

- Makhlouf, Gabriel (2020). “Making the case for macroprudential tools for the market-based finance sector: lessons from COVID-19”. Remarks prepared for Bruegel online event on “The need for market-based finance after COVID-19″ 29 June.https://www.centralbank.ie/news/article/speech-case-for-macroprudential-tools-for-mbf-covid-lessons-governor-makhlouf-29-june-2020

- Murray, Christian J. (2003). “Cyclical properties of Baxter-King filtered time series.” Review of Economics and Statistics, 85(2):472–476.

- O’Brien, Martin and Sofía Velasco (2020). “Unobserved components models with stochastic volatility for extracting trends and cycles in credit.” Research Technical Paper, Central Bank of Ireland.

- Quarles, Randal K. (2021) “The FSB in 2021: Addressing Financial Stability Challenges in an Age of Interconnectedness, Innovation, and Change.” At the Peterson Institute for International Economics, Washington, D.C. (via webcast) 30 March.

- Reinhardt, Dennis and Carlos van Hombeeck (2020). “With a little help from my friends: counter-cyclical capital buffers during the Covid-19 crisis.” Bank Underground, Bank of England. https://bankunderground.co.uk/2020/08/25/with-a-little-help-from-my-friends-counter-cyclical-capital-buffers-during-the-covid-19-crisis/

- Schüler, Y. S. (2018). “On the cyclical properties of Hamilton’s regression filter.” Deutsche Bundesbank Discussion Paper.

- Schüler, Y. S., Hiebert, P. P., and Peltonen, T. A. (2020)

About the author

Sofia Velasco is an economist in the Macro – Financial Division of the Central Bank of Ireland

- The concept of Risk Weighted Assets (RWA) was introduced with the idea of classifying the different assets by their risk. The aim of this calculation was to have a tool for to make comparison between banks easier across different geographies. In this framework, an asset weighted with 0% risk would not enter the denominator of capital ratios.

- Simplified representation does not take into account the buffers for systemically important banks, pillar 2 requirements or the systemic risk buffer.

- Borio (2014) characterises macro-financial imbalances by self-reinforcing interactions between perceptions of value and risk, attitudes towards risk and financing constraints.

- A sudden and large collapse in asset values that marks a return to an upward trajectory in the financial or business cycle is also known as a “Minsky moment”.

- Claessens et al. (2012), Jorda et al. (2011) and Jorda (2011) show that credit-induced financial disruptions lead to longer and deeper economic recessions.

- The Basel III legislation refers to the Basel-gap, which is computed by applying the one-sided Hodrick and Prescott (1997) low-pass filter calibrated using a smoothing parameter value of 400,000 to the credit-to-GDP ratio, as a measure of the credit cycle (for more information, see Bank for International Settlements (2010)).

- Choosing the duration of the cycle regardless of the underlying series introduces a sense of arbitrariness to the estimation. This entails the risk of casting spurious cycles (e.g. Harvey and Jaeger (1993); Cogley and Nason (1995); A’Hearn and Woitek (2001); Hamilton (2018); Schüler (2018) and Murray (2003)).

- For instance, Lang and Welz (2018), Galán and Mencia (2018) and O’Brien and Velasco (2020) apply multivariate unobserved components models of trend-cycle decomposition to estimate the financial cycle, while Schüler et al. (2020) estimate financial cycle frequencies using spectral analysis.

- This recommendation was issued by the European Systemic Risk Board (Recommendation ESRB/2014/1) following the CRD IV package comprising EU Directive 2013/36/EU and EU Regulation 575/2013 introduced in 2013.

- This result is based on a set of assumptions on target capital ratios and risk weights for new lending.

- For instance, total assets held by non-banks grew from €23 trillion in 2008 to €42 trillion in 2018 (de Guindos 2019).

- For a discussion on the developments in the market-based finance sector since the global financial crisis and on the impact of the Covid-19 shock on this sector, see Makhlouf (2020) and De Guindos (2019, 2020).